carbon tax benefits and disadvantages

As such it is. An Environment Compensation Charge was implemented by the National Green Tribunal to curb the increasing automobile.

Carbon Tax And Revenue Recycling Details Analysis Tax Foundation

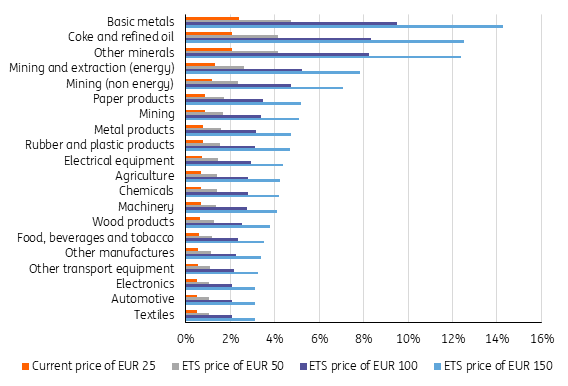

Additionally the high price could also encourage tax evasion and some firms may even try to hide their carbon emissions.

. So carbon tax would not exactly stop carbon dioxide production but would only change where and how it is produced. Carbon fails just a little quicker than. Thousands of cycles of weightunweight smallmed hits and forces on any material will eventually cause it to fail.

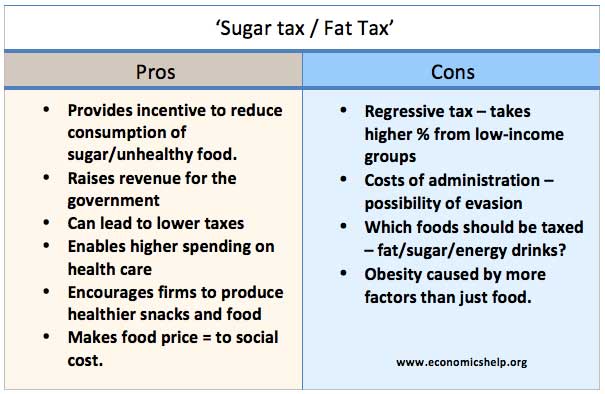

Critics focus on certain disadvantages of carbon taxes or cap-and-trade but their arguments are unpersuasive if policies are well-designed. A carbon tax reflecting the. Lower fatigue strength.

The price increase from the carbon tax would not be. Many critics believe that this type. Currently there is no tax that is enforced for pollution in India.

It carries the risk of cost increases. Lower prices will result in improved terms of trade which brings with it many additional benefits that make a carbon tax the unambiguously favorable option for a country. A carbon tax might lead me to insulate my home or refrain from heating under-occupied rooms thus reducing emissions at a lower cost than by using.

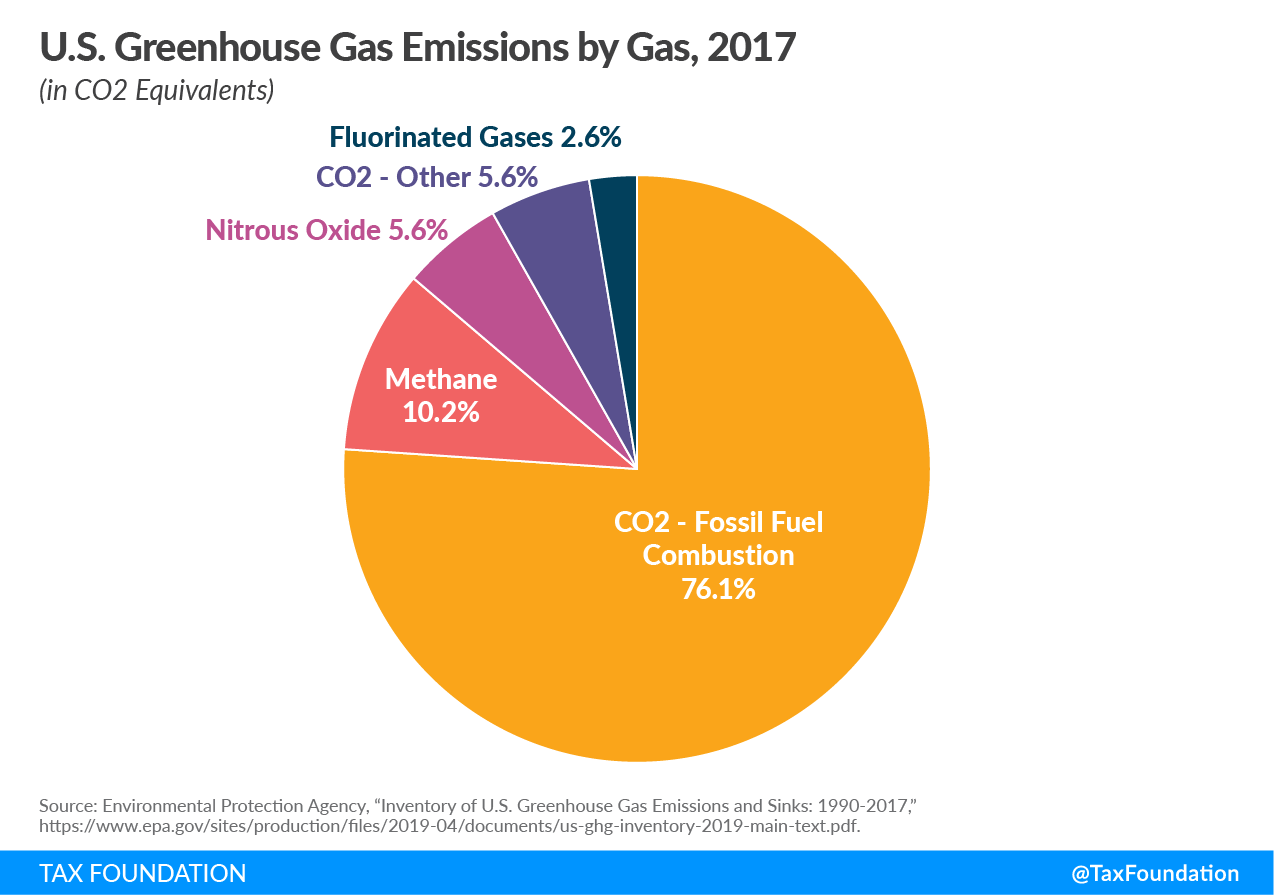

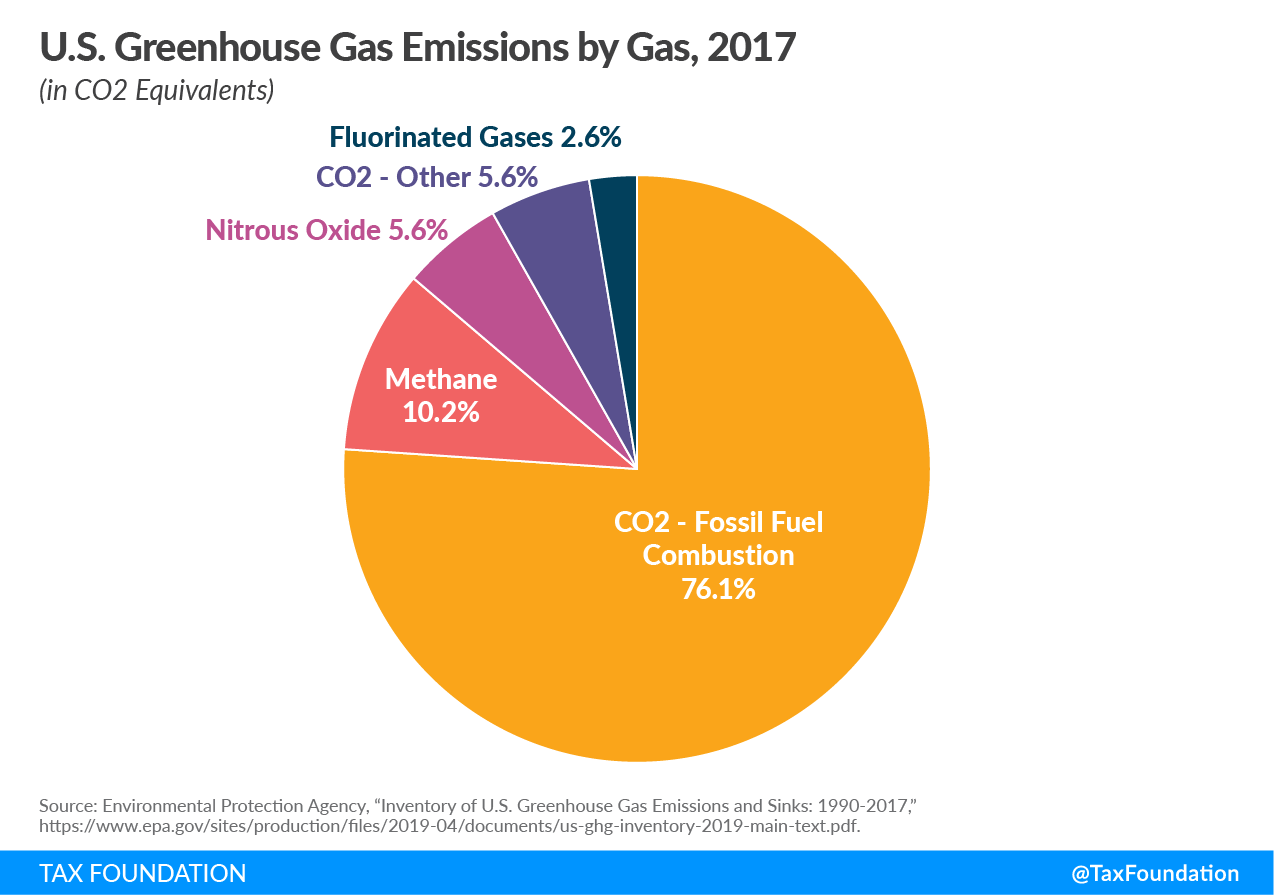

And although a carbon tax makes polluting activities more expensive it makes green technologies more affordable as the price signal increases over time. While a carbon tax does not offer. Carbon taxes only target carbon dioxide emitted from fossil fuels leaving out other carbon compounds such as methane from agriculture.

It is important to acknowledge that while both carbon tax vs carbon trading have their advantages and disadvantages theyre both sides of the same coin. Therefore a tax ensures everyone knows the price being paid at least for the immediate future for each unit of carbon dioxide emitted but uncertainty remains about the.

Could Revenue Recycling Make Effective Carbon Taxation Politically Feasible Science Advances

Ten Facts About The Economics Of Climate Change And Climate Policy

What A Carbon Tax Can Do And Why It Cannot Do It All

14 Advantages And Disadvantages Of Carbon Tax Vittana Org

Pragmatism Over Purism How To Design A Carbon Tax To Win Political And Social Support Iiea

The Pros And Cons Of Buying A Mobile Home Home Nation

Carbon Tax Pros And Cons Is Carbon Pricing The Right Policy To Implement Earth Org

Eu Carbon Border Tax Unnecessary For Now But Still A Good Idea Article Ing Think

Carbon Pricing In Canada Wikipedia

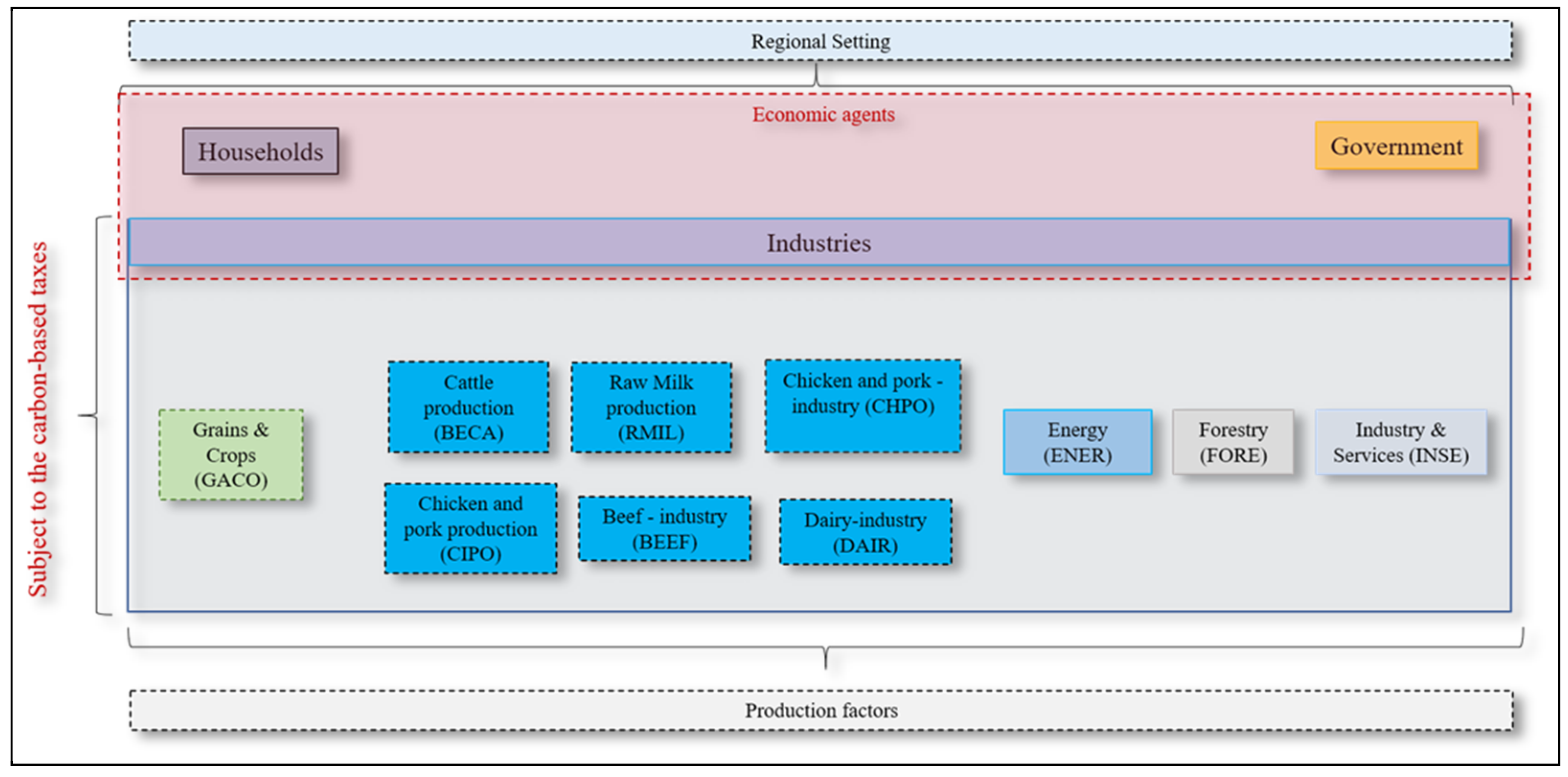

Sustainability Free Full Text Climate Change Policies And The Carbon Tax Effect On Meat And Dairy Industries In Brazil Html

/cdn.vox-cdn.com/uploads/chorus_asset/file/11706985/rgh_carbon_tax_2018_emissions.png)

Carbon Tax Debate The Top 5 Things Everyone Needs To Know Vox

27 Main Pros Cons Of Carbon Taxes E C

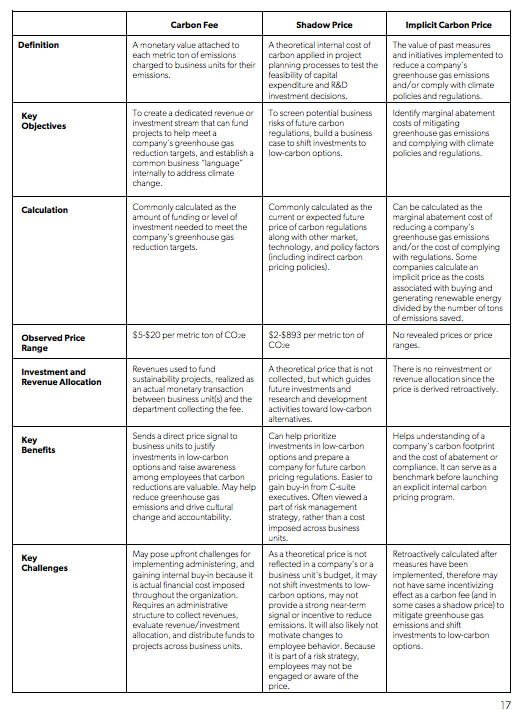

Carbon Pricing In The Private Sector The Cgo

Carbon Pricing In The Private Sector The Cgo

Columbia Sipa Center On Global Energy Policy What You Need To Know About A Federal Carbon Tax In The United States

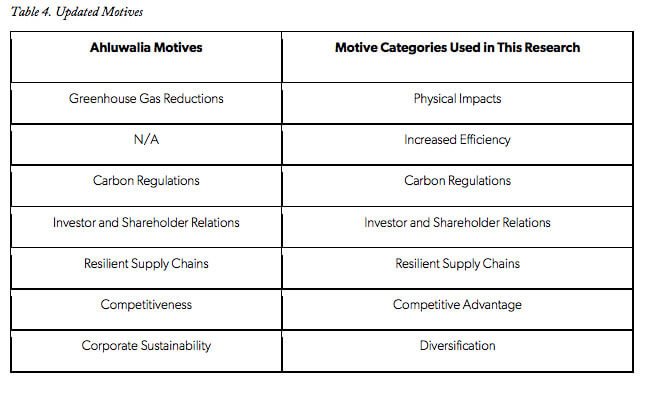

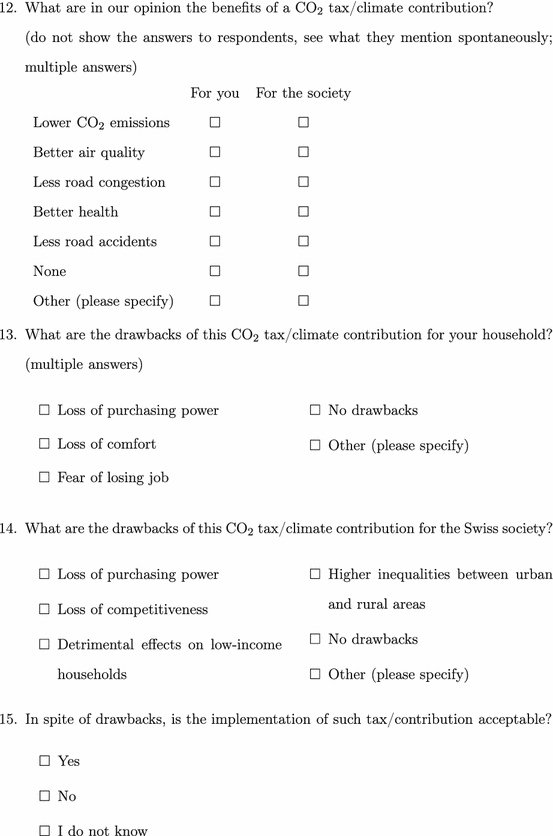

Effectiveness Earmarking And Labeling Testing The Acceptability Of Carbon Taxes With Survey Data Springerlink